You have chased and fulfilled your dream of running your own business. You are getting work, your customers are happy, and things are moving along. You get busy. Maybe a little too busy. One day you wake up and know you need to hire help. You can’t do it on your own anymore, your day only has 24 hours, and you are constantly working. Even your own pets don’t recognize you anymore.

You decide to post an ad and gather resumes. Some look very promising. You meet with a few candidates to assess their suitability and soon you have found the qualified person that will help you build and expand your business. This is very exciting. If only it wasn’t for all the paperwork that comes with hiring and paying staff! A good bookkeeper makes this process easy. Let’s take a look at your responsibilities as an employer and how a good bookkeeper can help you.

1. Select Salary or Hourly Payment

If you are considering an hourly payment approach for your employee(s), bear in mind that an hourly payroll takes time to process and, typically, you will need to run hourly payroll about 3 business days before the actual payday. This 3-day preparation time allows for processing by your bookkeeper and the bank, ensuring that direct deposit payments are transferred to the employee’s account by payday.Discussing these options with your bookkeeper will help you select the best payment approach based on you and your business.

2. Select Payroll Frequency

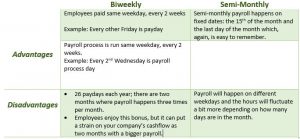

Although the options for payroll frequency include weekly and monthly, the most common pay-periods are biweekly and semi-monthly. A weekly payroll is too frequent to be practical for most businesses and monthly is too infrequent for most employees. That said, there may be a frequency that makes the most sense based on your business processes. I recommend you review the advantages and disadvantages of payroll frequency with your bookkeeper and they will advise the most suitable approach for your company. For example:

3. Select accounting software with payroll module or manually run your payroll

Programs such as Sage and Quickbooks allow for quick and easy processing of hourly and salaried payroll as they include a payroll module. The payroll tax tables are updated automatically, when required, and the programs run year end payroll requirements such as T4s.In contrast, if you only have 1 or 2 employees and are looking for a cheaper option, you might select software that does not include a payroll module. The CRA has an online, free payroll calculator (https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/payroll-deductions-online-calculator.html) which is a simple, straightforward payroll tool you can use to calculate the correct payroll deductions and give you a summary for the payroll remittance as well.Discuss both of these options with your bookkeeper and they can help determine the best fit for you and your company, saving you headache and money down the road.

4. Create a Hiring Package for Employees

There are several components that need to be covered in a hiring package such as:

- General Information – The employee’s phone number, an emergency contact, and the employee’s banking information (if you are paying them by direct deposit).

- Federal and Provincial TD1 form – This form can be downloaded from the CRA website and will contains their full name, mailing address, date of birth, and social insurance number.

- Tax Credit – The employee needs to fill in information about their tax credits, especially if they claim more than the basic amount.

- Employment Contract/Agreement – While a written contract is not mandatory, it can be helpful should any dispute arise between Employer and Employee. This contract should include the hiring date, payment cycle, benefits, and other position details.These forms can be outlined and drawn up by your bookkeeper as they know the obligations you must carry-out as an employer and they already know the best approaches to fulfill these obligations.

Hiring a good bookkeeper to help you setup and process your payroll is a big advantage to employers, saving them time and money each year. It allows you to focus on your business while passing along payroll information to your bookkeeper who will handle your payroll. Delegating your payroll process to your bookkeeper ensures a smooth payday, absent of headaches and complaints.